Arab National Bank- London

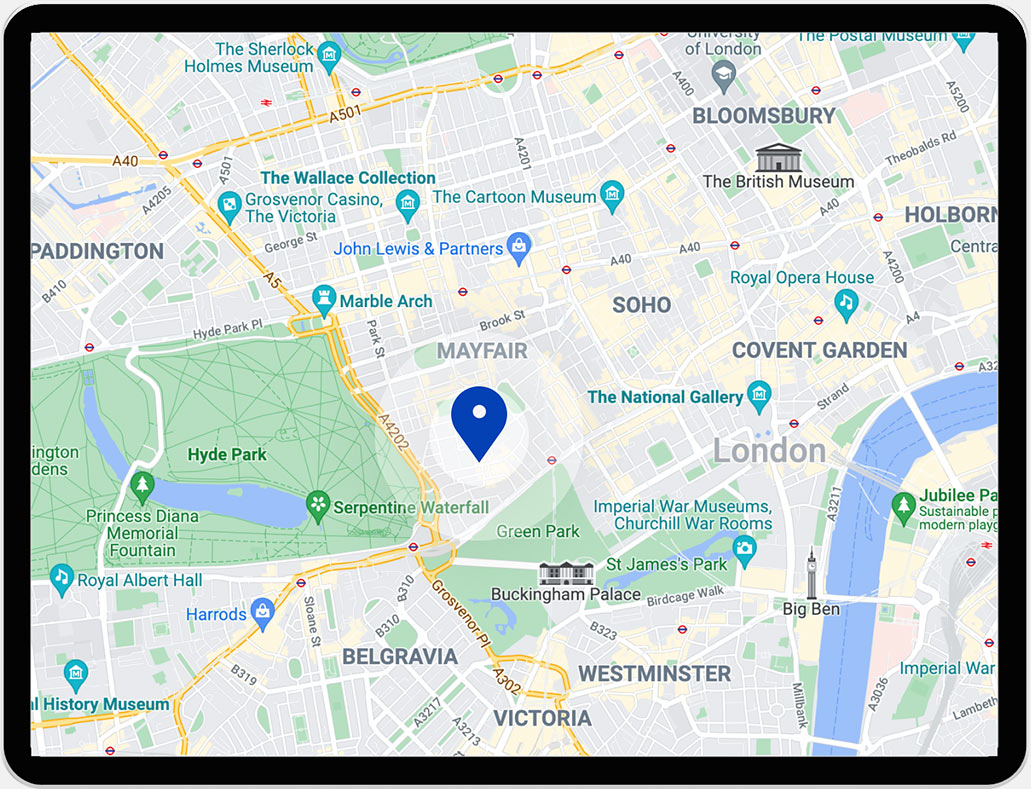

ANB London Branch is strategically located in Mayfair at the heart of the west-end of London and has been established in January 1991.

Whether you are in London on business or leisure, our team will provide you with a warm and friendly welcome and assist you with your banking requirements in the UK according to the highest standards with full privacy.

The focus of the Branch is to support Individuals and investors as well as support business activities for companies undertaking business in or with Saudi Arabia.

Banking Services:

A range of highly personalized banking services, delivered from a base of safety in mind. Take a step into opening an account in a range of currencies including GBP, EUR, USD and SAR, which allows you to conduct banking transactions in a smooth and efficient manner, in addition to other banking services which include:

• Standing Orders

• Direct Debits

• Cash withdrawals including foreign exchange and foreign currency services

• Bank Drafts Issuance

• Invoice/Bill Payment services

• Chequebooks

• Wire transfers both within the UK and to most major countries

• Debit Card

• Credit Card*

*Issued and managed by ANB, Saudi Arabia. Subject to separate application and approval; certain restrictions may apply. Kindly contact us for more details.

Treasury and FX services:

The Branch offers a range of treasury services, including a variety of deposits in major currencies as well as both spot and forward FX.

Credit:

Liquidity is a key element to a wealth management strategy. We offer Property Financing subject to separate application and approval. Certain restrictions may apply. Kindly contact us for more details.

Integrated Property Solutions:

The Branch has an extensive experience to assist with the purchase of residential or commercial property in the UK, particularly in London's upscale areas. We take you through the cycle from identifying a suitable property until the after-purchase service.

In addition, our relationship with large networks of property specialists, including estate and property agents, lawyers, surveyors, accountants and tax advisors can be called upon to be at your service, as required.

Property Finance:

We provide property finance in Sterling Pound to suit a type and size of property you are planning to purchase at both fixed and floating profit margins with easy payments. We also offer refinancing and finance against release equity from existing UK property investment(s).

Ancillary Property Services:

For your convenience, we manage the settlement of your properties' bills on time, while you are away.

Corporate Banking Services:

Please contact us regarding Corporate Banking Services.

Safe Deposit Boxes

The Branch offers highly secured Safe Deposit Boxes where you can keep your valuables on either a permanent or short-term basis.

» You can access your box anytime during normal Branch working hours.

» For extra safety, the box opens using dual key.

» The boxes are available in different sizes.

Financial Services Compensation Scheme (FSCS):

Your eligible deposits with ANB are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK's deposit protection scheme. In the case of Joint accounts, the protection is up to £120,000 per person across all of the accounts Joint account holders have.

Please ask for further information or visit the www.fscs.org.uk.

Address:

anb

PO Box 2LB

35 Curzon Street

London W1J 7TT