anb Mobile - anb

- Do not share your mobile and always use your private mobile to log into mobile banking service.

- Use a pin number to protect your mobile and keep it locked.

- Do not disclose any of your banking information to anyone such as accounts, user name, password or SMS alerts.

- Do not save your mobile banking user name, password, account number, ATM card number in your mobile.

- Make sure to log out successfully whenever you finish from using Mobile Banking Application.

- Make sure to download the official version of anb mobile through “App store”, “Google play” and "Huawei" only and do not acquire apps from untrusted sites.

- Avoid downloading any Apps that may conflict with anb mobile application. Your mobile will alert you if you are downloading a non-secure app. Do not ignore this message as such apps can make your phone vulnerable to threats and may compromise your device and its information.

- Always maintain the latest version of operating system and anb mobile on your device.

- Do not break the security system of your mobile by using any untrusted programs since it would make your device vulnerable to threats.

- Be careful whenever you browse untrusted/ unsecured websites, because it may contain some viruses which could damage your mobile.

- Make sure to provide the bank with a valid and updated mobile number.

- anb mobile application is a service offered by anb and its not allowed to use it for business purposes under any circumstances.

- In case of facing any issues please send a message to ebank@anb.com.sa or contact Phone Banking at 8001244040

- If you have already registered in anb net service then you can use the same user ID and password to login and use anb mobile.

- If you are a new user then click on the “Enroll to online banking” button visible on the login screen and follow the simple steps to get onboard.

feature allows you to manage all your finances in one place

It's a new channel that enables anb retail customers to perform their banking transactions easily through their smart phone devices.

ID number (Valid ID).

Primary mada card number (Active).

mada card PIN number.

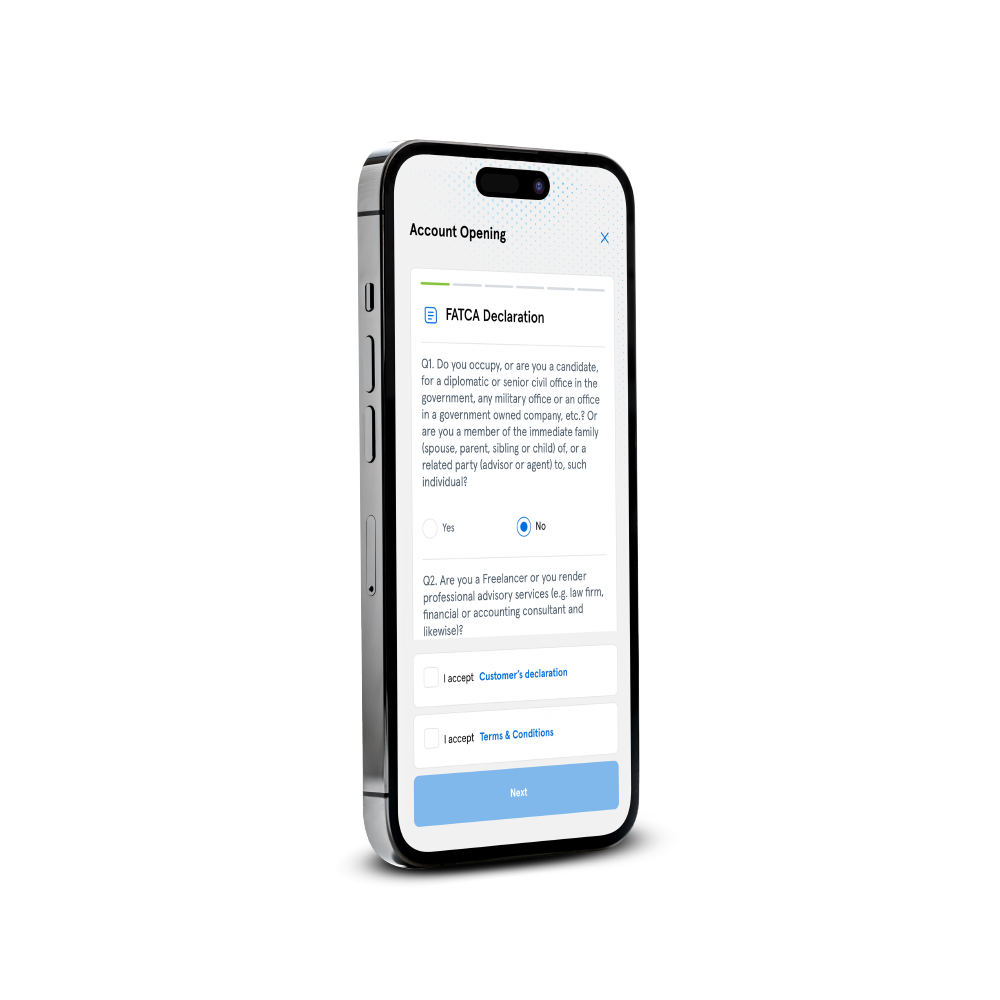

- Open a new account in anb.

Registration in anb mobile.

Reset password.

Forgot user name.

Login with biometrics.

Save user ID.

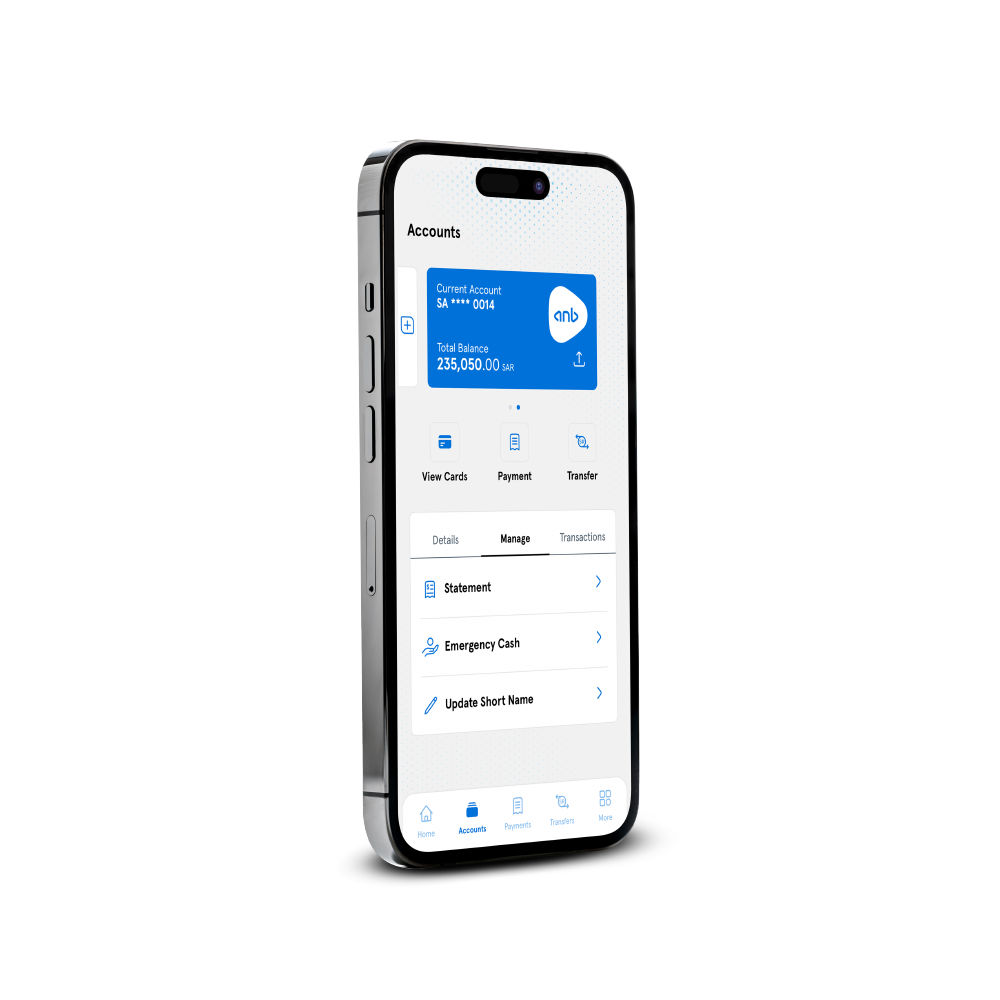

Accounts:

- List of all current and saving accounts.

- Account full statement (Last 6 months).

- Account details.

- Emergency Cash (Cash withdrawal from an ATM without mada card).

- Open Sub-account (Current/ Saving).

- Edit daily transfers limits

Transfers:

- Between customer's accounts.

- To another anb account.

- To local banks.

- To international banks.

- To Investments houses.

Manage Beneficiaries:

- Add new beneficiary.

- Delete existing beneficiary.

- Activate beneficiary.

- View beneficiary's details.

- Edit beneficiary's shot name.

mada card:

- Mada card details.

- Mada card PIN change.

- Purchase limit change (via POS / E-commerce).

- Add the card to Apple Pay.

- Show CVV

- Stop mada card.

- Apply for mada digital card.

Credit Card:

- Credit card list.

- Credit card details.

- Credit card statement.

- Credit card payment (full, partial , and minimum amount).

- Cash advance.

- View unbilled transactions.

- Apply for new Credit Card.

- Show Rewards.

Bill Payments:

- View a list of all bills.

- Pay a bill or Multiple bills.

- Pay Once.

- Add new bill.

- Delete a bill.

- Activate a bill.

- Esal Services.

- Display transaction limits for all financial transactions

IPO: This service will be available upon IPOs.

Time deposit Details: View the time deposits details.

Finance Products: View financing details (Personal finance and real estate finance).

Apply for personal finance, Micro lending and salary advance.

Government Payments: Pay government service fees and traffic violations.

Investment Products: View the investment account (account details / Transactions / transfer from/to the investment account and the current account).

Products:

Apply for open sub-account (current/saving).

Apply for issue a mada digital card or credit card.

Apply for personal finance, Micro lending and salary advance.

Apply for open an investment account (brokerage / equity funds / money market and trading funds / multi asset funds / sukuk funds).

Sign up in telemoney service.

- iOS version 8.0 and above / Android OS version 4.2 and above.

Yes, anb mobile applies high security standards.

The application does not store any of your personal banking information.

Yes, you can register easily from the Kingdom or abroad if you have all required banking information.

In login screen you will find an item "Forget password and User ID" press on it and follow the steps.

Yes, but when you enter your user name and password then you will be asked to follow a simple activation process.

You can view all your existing accounts (current accounts, saving accounts, Investment accounts, credit cards, and time deposits).

Transaction limits will be displayed while you perform any financial transaction. The limits are dynamic and will be updated based on usage.

After adding the beneficiary via the anb mobile application, you need to press activate beneficiary and you will receive a call to your mobile number registered on the system to activate the beneficiary. Also, you can activate the beneficiaries by calling anb Phone Banking at 8001244040.

Yes

anb has several major currencies in the world as shown below:

AUD - Australian Dollar.

BHD - Bahraini Dinar.

GBP - British Pound.

CAD - Canadian Dollar.

EUR - Euro.

INR - Indian Rupee.

JPY - Japanese Yen.

KWD - Kuwaiti Dinar.

MAD - Moroccan Dirham.

OMR - Omani Riyal.

QAR - Qatari Riyal.

DKK - Danish Krone.

JOD - Jordanian Dinar.

SEK - Swedish Krona.

SAR - Saudi Riyal.

CHF - Swiss Franc.

AED - Emirati Dirham.

Yes, the customer can settle all service bills or government payments through the current account or credit card.

Log in to anb mobile application

transfer menu > Choose quick transfer

Set up the transaction limit (maximum SR 2500)

Select the account that you want to link with the alias (you can define more than one account)

Select the alias ID you want from the list (mobile number - ID number - email address)

Go to “Transfers” option from the main menu to conduct your Transactions.

By entering into the anb application, clicking on "Open an Account" to join anb, and completing the account opening procedures.

Log in to the anb application, then go to the "More" page and click on "Loans" from the "My Products" menu.

Yes, by entering into the anb application, going to the "Transfers" page, and clicking on "Standing Instructions".

Yes, you can do that by entering into the anb application, clicking on the profile icon, and selecting "My Information".