Cashee - anb | Empowering Youth with Financial Literacy - anb

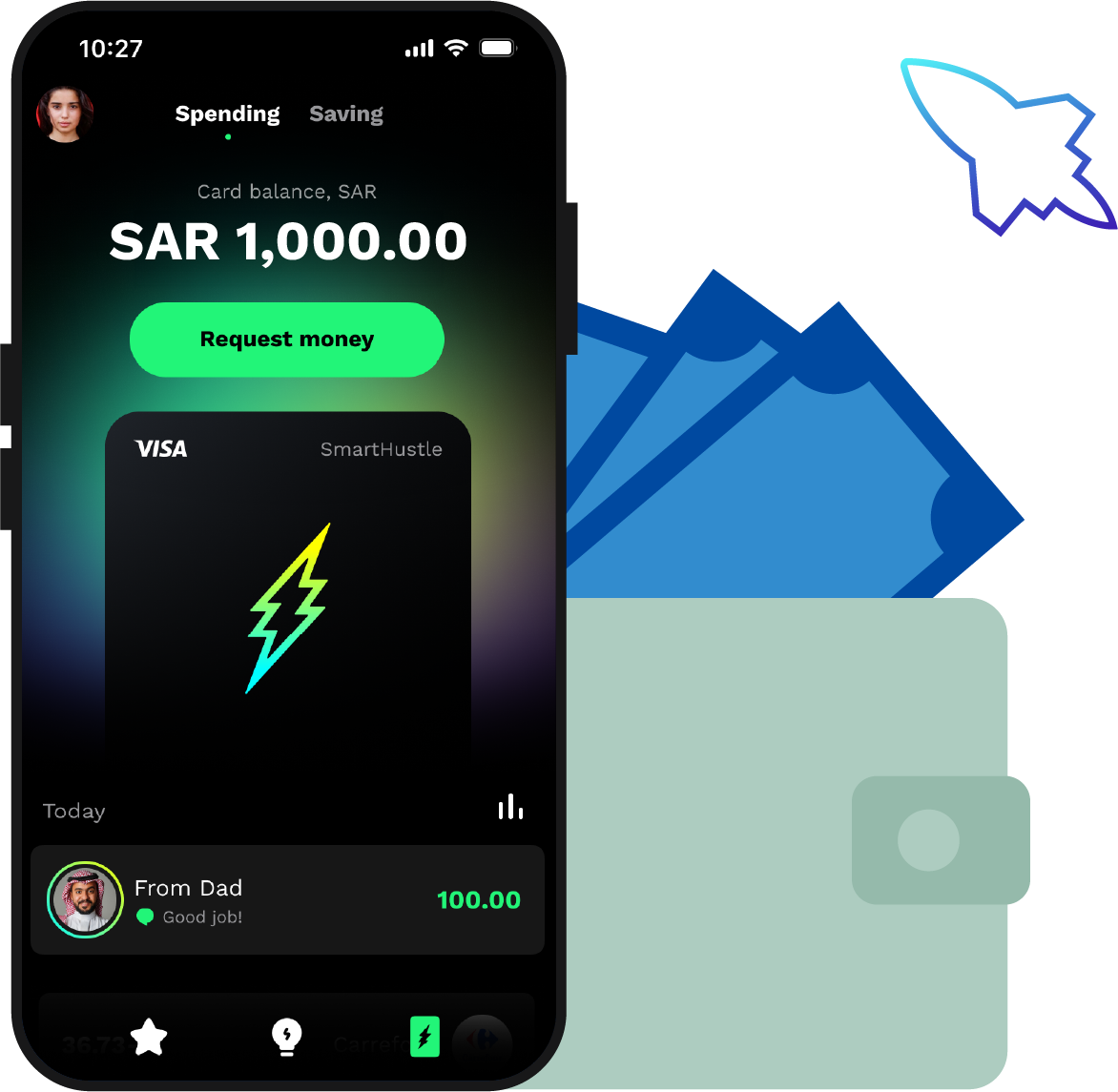

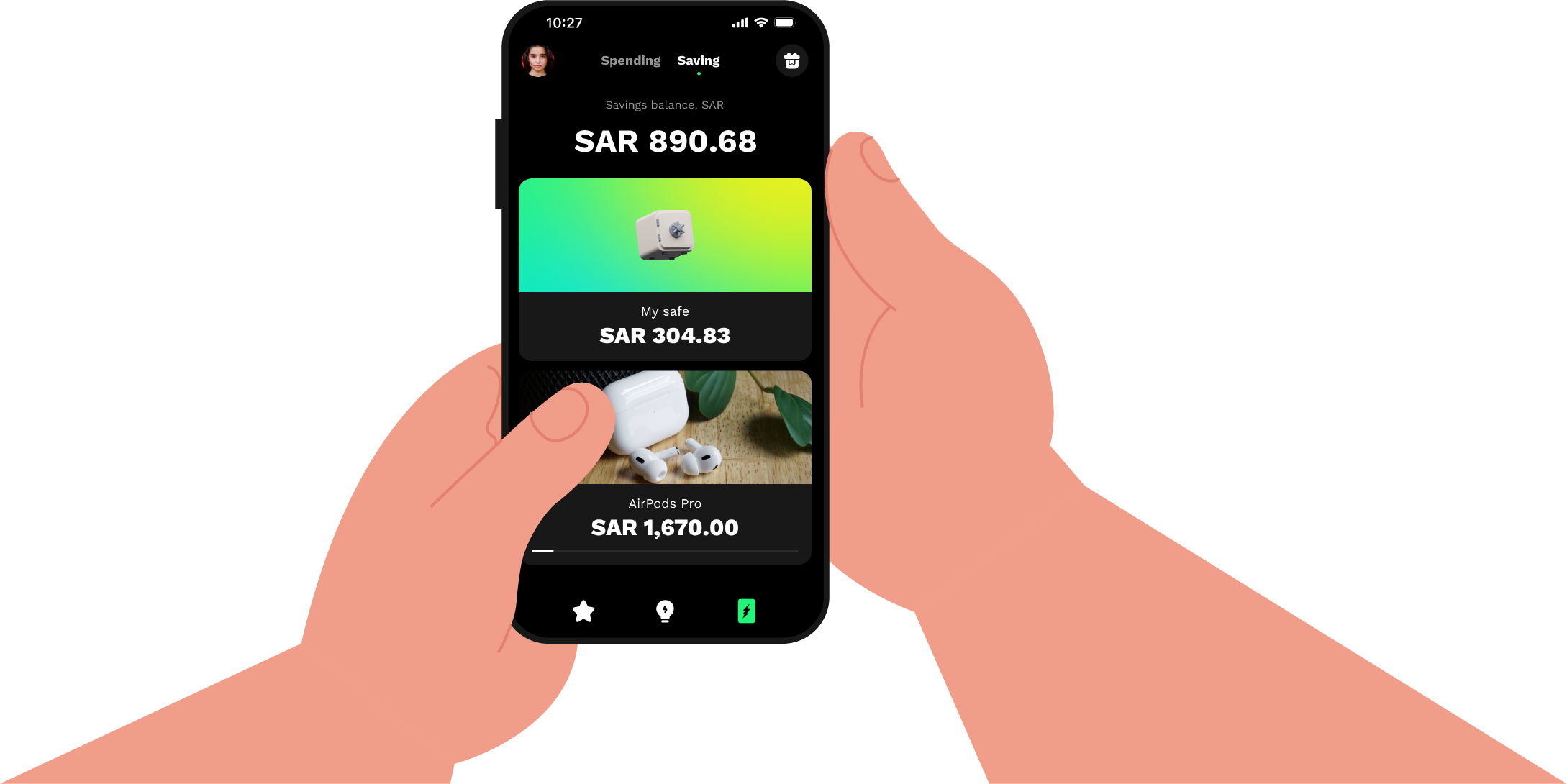

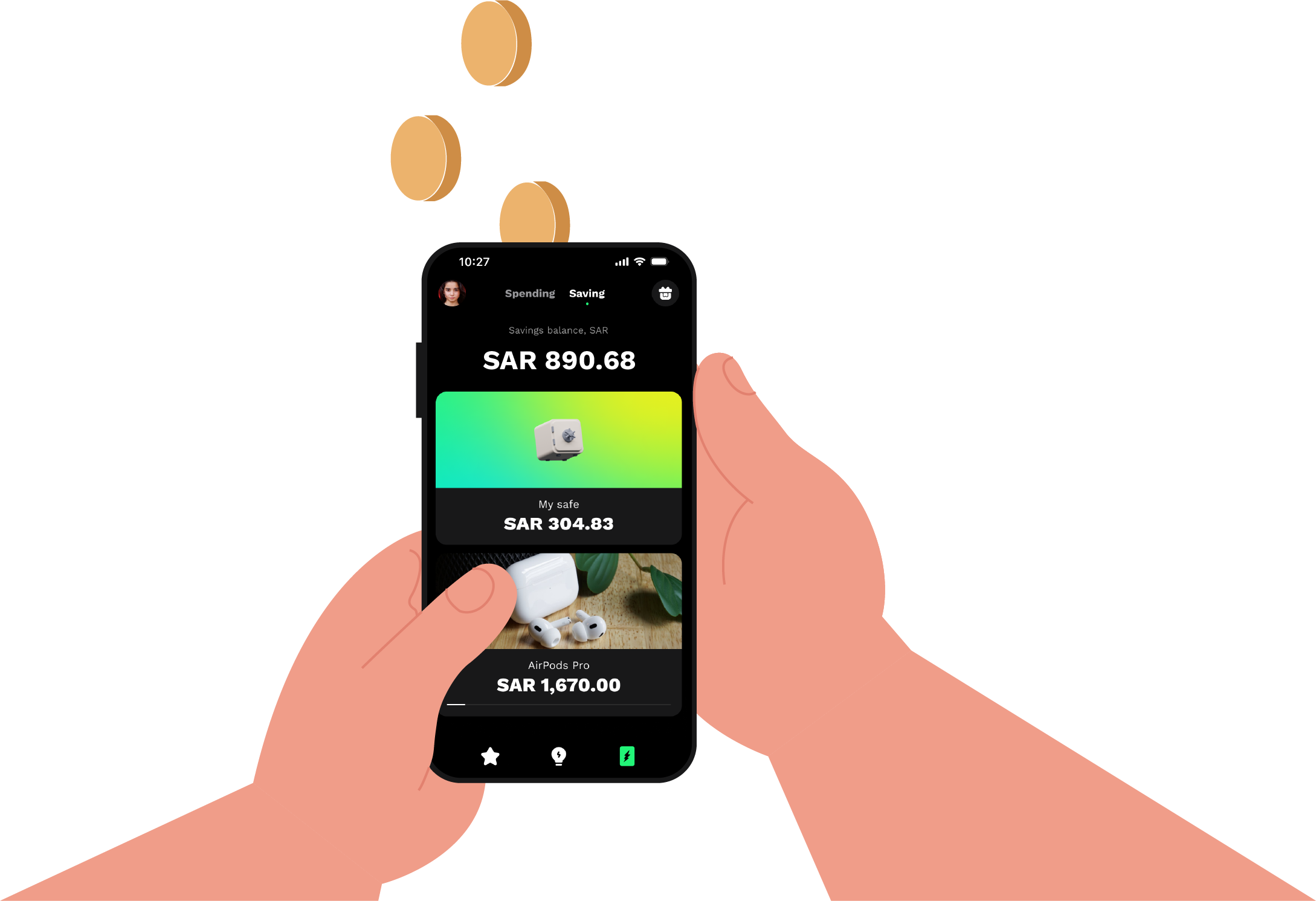

Cashee offers a free for the first year prepaid Visa Card and a mobile app to youth aged 6 to 18 in Saudi Arabia.

- Parent Sign-Up: To set up your Cashee account, if you're aged 6-18, ask your parent to sign up first.

- Required Information: Your parent will need to provide their KSA registered mobile number and National Identification number during sign-up.

- For Non-anb Account Holders: If your parent doesn't have an anb account, they will be directed to anb website to create one. This anb account will then be linked to their Cashee app.

- For anb Account Holders: If your parent already has an anb account, it will automatically connect to their Cashee app.

- Creating Child Accounts: Once your parent successfully creates their Cashee parent account, they can create Cashee accounts for up to 5 children.

- Child Account Activation: After your parent creates your account, you can log in using the mobile number they used during setup and create your own passcode.

Download App Now :

2- KSA National ID

3-Date of Birth

Parents can add up to 5 children under their Cashee Account.

To register for Cashee, possession of a KSA National ID is mandatory. At present, we are unable to accommodate individuals residing in Saudi Arabia who lack a National ID.

When activating your Cashee card, you will be prompted to create a PIN within the Cashee application.

In the unfortunate event that your card is lost or stolen, you have two options:

1- Freeze your card: You can easily freeze your card instantly in the Cashee app by clicking on the card image on the Home screen and then selecting the Freeze card icon. You are then free to follow the same procedure to Unfreeze the card if it is later found.

A parent can also freeze the card by first selecting the child whose card needs to be frozen. They can then click the card icon and then select the freeze icon. You can unfreeze the card if it is later found.

2- Block your card: Only a parent can Block and Replace a card. They can select the child whose card they wish to cancel. They can click the card icon and then select the Block and Replace icon. A replacement card request is automatically created, and a one-off cost will be debited from the parent account. Please ensure there are sufficient funds in the parent account before canceling the child’s card

Currently we don't offer the option to withdraw funds from an ATM using your Cashee Card.

Cashee card is free for the first year. A replacement card will be charged.

After year one, a parent will be charged a fee of SAR 69 (VAT included)per year.

All your funds are held securely by arab national bank (anb)

Like any ordinary bank account, these funds are fully protected by anb.

The purpose is to create a better control of cardholder data and reduce fraud.

Cashee is audited constantly throughout the year to ensure its processes and systems meet this high standard of protection

By email: casheesupport@anb.com.sa

By phone: 800 1111 767.